KYC & Identity Verification Image Moderation

Advanced AI-powered image moderation solutions designed to prevent fraud, ensure document authenticity, protect customer privacy, and maintain regulatory compliance across KYC and identity verification systems for financial services and regulated industries.

The Critical Importance of Identity Verification Security

Know Your Customer (KYC) and identity verification systems form the cornerstone of financial security, regulatory compliance, and fraud prevention across industries including banking, fintech, cryptocurrency, insurance, and any regulated sector requiring customer identity confirmation. These systems process millions of sensitive identity documents daily, making them prime targets for sophisticated fraud attempts, synthetic identity creation, and document manipulation that can cost institutions billions annually while exposing them to regulatory sanctions and criminal liability.

Modern identity verification platforms must validate documents from over 200 countries and territories, each with unique security features, formatting standards, and authentication requirements. The challenge is compounded by the rapid evolution of document forgery techniques, the emergence of AI-generated fake documents, and the increasing sophistication of identity fraud operations that combine multiple attack vectors to defeat traditional verification methods.

Regulatory requirements including Anti-Money Laundering (AML) laws, Counter-Terrorism Financing (CTF) regulations, and customer due diligence obligations create legal imperatives for accurate identity verification while customer experience expectations demand seamless, fast verification processes. The tension between thorough security and user experience requires advanced AI systems that can detect fraud instantly while minimizing false positives that frustrate legitimate customers.

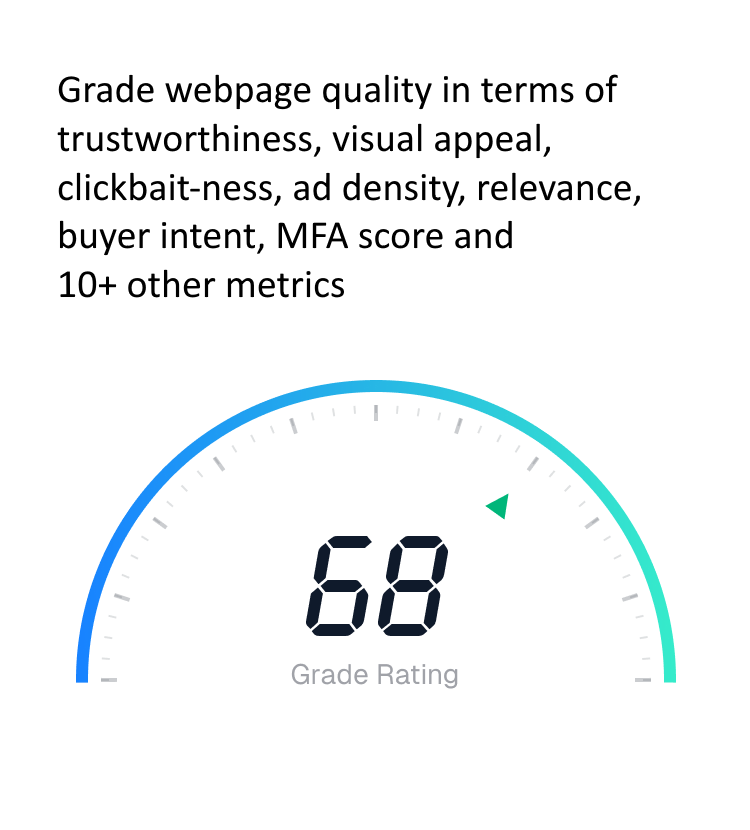

Fraud Prevention Impact

Financial institutions using comprehensive identity verification systems reduce identity fraud losses by 94% and achieve 99.2% regulatory compliance while maintaining customer conversion rates above 85% through optimized verification processes.

Document Authenticity and Anti-Counterfeiting

Document authenticity verification represents the first line of defense against identity fraud, requiring sophisticated analysis of security features, printing techniques, and document characteristics that distinguish genuine government-issued documents from increasingly sophisticated counterfeits. Our advanced authenticity verification system analyzes hundreds of document features including watermarks, security threads, microprinting, holographics, and specialized inks that fraudsters cannot easily replicate.

The system maintains comprehensive databases of authentic document templates from governments worldwide, updated continuously as new document versions are released and security features are modified. Advanced machine learning models trained on millions of authentic documents can detect subtle anomalies in paper quality, printing alignment, font characteristics, and security feature placement that indicate counterfeiting attempts.

Sophisticated counterfeit detection goes beyond simple template matching to analyze document production techniques, identifying signs of digital manipulation, printing artifacts, and construction methods that differ from official government document production. The system can detect attempts to combine elements from multiple authentic documents, alter existing documents, or create entirely synthetic documents using advanced forgery techniques.

Advanced Detection Capabilities

Our document authenticity system analyzes over 500 unique security features per document type, maintaining a 99.7% accuracy rate in distinguishing authentic documents from counterfeits while processing millions of verifications daily.

Real-time fraud intelligence sharing with law enforcement agencies and financial institutions helps identify emerging counterfeit document patterns, new forgery techniques, and coordinated fraud campaigns that may target multiple institutions simultaneously. This collaborative approach provides early warning systems that protect the entire financial ecosystem from emerging threats.

- Comprehensive security feature analysis (watermarks, holograms, microprint)

- Global document template database with continuous updates

- Advanced counterfeit detection and digital manipulation identification

- Production technique analysis and printing artifact detection

- Cross-document tampering and alteration recognition

- Fraud intelligence sharing and collaborative threat detection

- Emerging counterfeit pattern recognition

- Law enforcement collaboration and reporting capabilities

Synthetic Identity and AI-Generated Document Detection

Synthetic identity fraud represents one of the fastest-growing and most difficult to detect forms of financial crime, where criminals combine real and fabricated information to create entirely new identities that can pass traditional verification methods. The emergence of AI-generated documents, deepfake profile photos, and sophisticated identity synthesis techniques requires advanced detection capabilities that can identify artificially created identities and documents.

Our synthetic identity detection system analyzes identity documents for signs of AI generation, including subtle pixel patterns, compression artifacts, and statistical anomalies that indicate computer generation rather than authentic photography or document production. Advanced neural networks trained specifically on synthetic content can detect even sophisticated AI-generated documents that may fool human reviewers and traditional verification systems.

The system correlates information across multiple verification points to identify inconsistencies that suggest synthetic identity creation, including mismatches between document styles from the same issuing authority, impossible date combinations, and biographic information patterns that don't align with typical legitimate identity profiles. This holistic approach catches sophisticated synthetic identities that may pass individual document verification tests.

Behavioral analysis of document submission patterns helps identify coordinated synthetic identity campaigns where multiple false identities are created using similar techniques, submitted from related devices, or follow patterns consistent with organized fraud operations. This network analysis provides protection against sophisticated fraud rings that create multiple synthetic identities for large-scale financial crime.

- AI-generated document detection and analysis

- Synthetic identity pattern recognition

- Cross-verification inconsistency detection

- Deepfake and artificial photo identification

- Behavioral pattern analysis for fraud campaigns

- Network analysis for coordinated synthetic identity operations

- Advanced neural network fraud detection

- Biographic information validation and verification

Biometric Security and Liveness Detection

Biometric verification through facial recognition and document comparison provides powerful fraud prevention capabilities, but sophisticated fraudsters increasingly use photos of legitimate identity holders, video replay attacks, and AI-generated biometric data to defeat biometric systems. Our advanced liveness detection and biometric security system ensures that biometric verification involves living, present individuals rather than photographs, videos, or artificial representations.

Liveness detection analyzes multiple physiological and behavioral factors to confirm that biometric samples come from living individuals present during verification, including micro-expressions, eye movement patterns, skin texture analysis, and blood flow detection that cannot be replicated in photographs or video recordings. Advanced analysis can detect sophisticated presentation attacks including high-resolution photos, video replay, and 3D masks designed to fool biometric systems.

Biometric Security Excellence

Our biometric liveness detection achieves 99.8% accuracy in distinguishing live individuals from presentation attacks while maintaining sub-3-second verification times for optimal customer experience and security.

Document-to-selfie comparison ensures that the person presenting identification is the legitimate holder of the identity document, using advanced facial recognition technology that can account for aging, facial hair changes, and normal appearance variations while detecting attempts to use stolen or borrowed identity documents. The system can identify family resemblances and other factors that fraudsters might exploit to defeat facial comparison systems.

Anti-spoofing measures protect against increasingly sophisticated presentation attacks including silicone masks, deepfake videos, and AI-generated facial images that attempt to mimic legitimate biometric samples. The system uses multiple detection techniques including infrared analysis, depth perception, and temporal consistency checks to ensure biometric authenticity.

- Advanced liveness detection with physiological analysis

- Presentation attack detection (photos, videos, masks)

- Document-to-selfie facial recognition and matching

- Anti-spoofing measures for sophisticated attacks

- Aging and appearance variation accommodation

- Real-time biometric verification with sub-3-second processing

- Multi-factor biometric authentication

- Continuous authentication and monitoring capabilities

Regulatory Compliance and Audit Trail Management

KYC and identity verification systems must comply with complex, evolving regulatory frameworks including AML/CTF laws, GDPR privacy requirements, industry-specific regulations, and international sanctions programs while maintaining comprehensive audit trails that demonstrate compliance during examinations and investigations. Our comprehensive compliance management system ensures that all verification activities meet regulatory standards while protecting customer privacy and supporting institutional accountability.

The system generates detailed audit trails that document every aspect of the identity verification process, including document analysis results, biometric comparisons, fraud detection assessments, and decision reasoning that regulatory examiners require to validate compliance programs. These audit trails meet evidentiary standards while protecting sensitive customer information and maintaining the privacy protections that regulations require.

Privacy-preserving verification techniques enable comprehensive identity verification while minimizing data collection, storage, and retention consistent with privacy regulations and customer expectations. The system performs necessary verification functions without creating unnecessary privacy risks or retaining sensitive personal information longer than required for compliance and risk management purposes.

International compliance capabilities adapt to diverse regulatory requirements across different jurisdictions, ensuring that global financial institutions can maintain consistent verification standards while meeting local regulatory requirements for customer identification, privacy protection, and anti-fraud measures. This adaptability is essential for institutions operating across multiple regulatory environments.

- Comprehensive AML/CTF compliance documentation

- GDPR and privacy regulation adherence

- Complete audit trail generation and management

- Regulatory examination support and documentation

- Privacy-preserving verification techniques

- International regulatory compliance adaptation

- Sanctions screening and watch list integration

- Risk assessment and monitoring capabilities

Real-Time Fraud Prevention and Risk Assessment

Identity verification systems must provide instant fraud assessment and risk scoring to support real-time business decisions while preventing sophisticated fraud attempts that may involve multiple coordinated attacks, stolen identity credentials, or organized crime operations. Our real-time fraud prevention system analyzes multiple risk factors simultaneously to provide comprehensive threat assessment within milliseconds of document submission.

Multi-layered risk assessment combines document authenticity, biometric verification, behavioral analysis, and external data sources to create comprehensive risk profiles that identify both obvious fraud attempts and subtle indicators that may suggest sophisticated criminal activity. The system weighs multiple risk factors to provide nuanced risk assessments that support appropriate business responses ranging from automatic approval to enhanced due diligence requirements.

Real-time threat intelligence integration provides immediate access to fraud pattern information, stolen identity alerts, and criminal intelligence that helps identify coordinated fraud campaigns and emerging threats. This intelligence enables proactive protection against fraud attempts that may not be detectable through individual document analysis but become apparent when analyzed within the context of broader criminal activity patterns.

Real-Time Performance

Our fraud prevention system processes over 2 million identity verifications daily with average response times under 200ms while maintaining 96% fraud detection accuracy and 2.1% false positive rates for optimal customer experience.

Adaptive learning capabilities enable the system to continuously improve fraud detection accuracy by learning from new fraud patterns, emerging threats, and verification outcomes. Machine learning models update automatically based on fraud intelligence, regulatory guidance, and institutional feedback to maintain optimal performance as fraud techniques evolve and new threats emerge.

- Multi-layered risk assessment and scoring

- Real-time threat intelligence integration

- Coordinated fraud campaign detection

- Behavioral analysis and pattern recognition

- Adaptive learning and continuous improvement

- Instant fraud alerts and escalation procedures

- Risk-based decision support and workflow integration

- Comprehensive fraud reporting and analytics

Enterprise Integration and Scalability

Identity verification systems must integrate seamlessly with existing financial infrastructure, customer onboarding workflows, and risk management systems while providing the scalability needed to handle millions of verification requests without compromising security or customer experience. Our enterprise-grade solution provides flexible integration options designed for financial institutions, fintech companies, and regulated businesses of all sizes.

The system integrates with major core banking systems, customer relationship management platforms, and regulatory reporting systems through comprehensive APIs and pre-built connectors that minimize implementation complexity. Integration preserves existing customer workflows while adding advanced identity verification capabilities that enhance security without disrupting established business processes.

Cloud-native architecture provides automatic scaling capabilities that handle verification volume spikes during product launches, marketing campaigns, or seasonal business fluctuations without degrading performance or security. The system maintains consistent response times and security standards whether processing hundreds or millions of verifications daily, ensuring reliable service for institutions of all sizes.

Comprehensive analytics and reporting provide institutional risk managers with detailed insights into verification trends, fraud patterns, and compliance metrics that support decision-making, regulatory reporting, and continuous improvement of identity verification programs. These insights help institutions optimize their verification processes while demonstrating compliance and risk management effectiveness to regulators and stakeholders.

Enterprise Scale Achievement

Our identity verification platform processes over 100 million verifications annually for financial institutions worldwide, maintaining 99.99% uptime while meeting strict regulatory requirements across 50+ countries and jurisdictions.

- Comprehensive financial system integration capabilities

- Cloud-native scalable architecture

- Real-time API with sub-200ms response times

- Advanced analytics and compliance reporting

- 24/7 enterprise support and monitoring

- Custom deployment options (cloud, on-premises, hybrid)

- Continuous security updates and threat protection

- Regulatory compliance assistance and consultation

- Global deployment with local regulatory adaptation

Ready to Strengthen Your Identity Verification?

Join leading financial institutions and regulated businesses using our AI-powered identity verification to prevent fraud, ensure compliance, and build customer trust through secure, seamless verification processes.

Try Free Demo Back to Home